Loading... Please wait...

Loading... Please wait...- Home

- Guru

-

MEGA List

- MEGA List Page

- Categories

- All Brands

- Trading Books

- AdvancedGET

- MetaStock

- MetaStock Add-ons

- MetaStock Plug-Ins

- MetaStock Utilities

- MetaTrader

- MetaTrader EA

- MetaTrader EA (Forex)

- NinjaTrader

- Statistical Analysis

- TradeStation

- TradeStation Add-Ons

- Trading Software

- Betting Exchange Software

- Mega Page - New Stuff

- Personal Development Courses

- More MEGA LIST

- More Courses_

- Books

- More Books

- Mega List #1

- Mega List #2

- Mega List #3

- Real Estate

- Course by Category #1

- Course by Category #2

- Course by Author #1

- Course by Author #2

- Course by Author #3

- Course by Author #4

- RosettaStone

- Mega Page - 0

- Mega Page - A

- Mega Page - B

- Mega Page - C

- Mega Page - D

- Mega Page - E

- Mega Page - F

- Mega Page - G

- Mega Page - H

- Mega Page - I

- Mega Page - J

- Mega Page - K

- Mega Page - L

- Mega Page - M

- Mega Page - N

- Mega Page - O

- Mega Page - P

- Mega Page - Q

- Mega Page - R

- Mega Page - S

- Mega Page - T

- Mega Page - U

- Mega Page - V

- Mega Page - W

- Mega Page - X

- Mega Page - Y

- Mega Page - Z

- MEGA CATALOG

- Search MEGA CATALOG

- Entire 3TB Hard Drive for DayTraders - For Sale $3K

- Entire 4TB Hard Drive for DayTraders – For Sale $4K

- BigBoss Hard Drive for DayTraders – For Sale $3K

- MONEY Catalog

- Some More Courses

- dvd

- estore

- libr

- shop

- store

- Portfolio

- BigBoss Hard Drive for DayTraders

- Latest Database

- FAQ

- Info

-

Market Summary

- Corona Virus Stocks

- FREE IBD WEEKLY

- FREE STOCK CHARTS

- Market.Summary

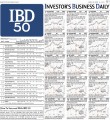

- IBD 50

- DOW 30

- NASDAQ 100

- CNBC IQ 100

- IBD Sector Leaders

- IBD Stock Spotlight

- IBD Big Cap 20

- IBD CANSLIM Select

- IBD Global Leaders

- IBD IPO Leaders

- IBD New Highs

- IBD Rising Profit Estimates

- IBD Relative Strength At New High

- IBD Stocks That Big Mutual Funds Are Buying

- IBD Weekly Review

- IBD Stocks On The Move Up

- IBD Stocks On The Move Down

- Zacks Rank #1 Strong Buys

- Zacks Rank #5 Strong Sells

- Zacks Focus

- SPDR XLB Basic Materials

- SPDR XLC Communication Services

- SPDR XLE Energy

- SPDR XLF Financial

- SPDR XLI Industrials

- SPDR XLK Technology

- SPDR XLP Consumer Staples

- SPDR XLRE Real Estate

- SPDR XLU Utilities

- SPDR XLV Healthcare

- SPDR XLY Consumer Discretionary Goods

- Direxion Leveraged & Inverse ETFs

- IBD Innovator ETFs

- Technology ETFs

- Select Sector SPDR ETFs

- MARKET_SUMMARY

- 52 Week High Stocks

- 52 Week Low Stocks

- AGFiQ ETFs

- Airline Stocks

- Barron Stock Picks

- Bond ETFs

- IBD CANSLIM Grand Slam

- Casinos Gaming Stocks

- Commodity ETFs

- Equity ETFs

- ETF Investor

- First Trust ETFs

- Four Horsemen

- Home Run Investor

- IBD Breakout Opportunities ETF

- IBD Breakout Stocks

- IBD Dividend Leaders

- IBD ETF Leaders

- IBD Income Investor

- IBD REIT Leaders

- IBD Tech Leaders

- IBD Utility Leaders

- Income Investor

- International ETFs

- Invesco ETFs

- iShares ETFs

- JPMorgan ETFs

- Large Cap ETFs

- Marijuana Stocks

- Mid Cap ETFs

- ProShares ETFs

- REITs

- Sector ETFs

- Small Cap ETFs

- SPDR State Street Global Advisors ETFs

- Stocks at All Time Highs

- Stocks at All Time Lows

- Stocks Under $10

- Top 80 Technology ETFs

- Travel Hotel Stocks

- US Small Cap ETFs

- USAA ETFs

- Value Investor

- Warren Buffett Berkshire Hathaway Portfolio

- WisdomTree ETFs

- Zacks Top 10 Stocks

- Market Summary 2

- Publicly Traded Advertising and Marketing Stocks

- Publicly Traded Aerospace & Defense Stocks

- Publicly Traded Agricultural Stocks

- Publicly Traded Aviation Stocks

- Publicly Traded Biotech Stocks

- Publicly Traded Building Product and Materials Stocks

- Publicly Traded Business Service Stocks

- Publicly Traded Chemical Stocks

- Publicly Traded Clean Energy Stocks

- Publicly Traded Clothing and Footwear Stocks

- Publicly Traded Construction Stocks

- Publicly Traded Consumer Goods Stocks

- Publicly Traded Consumer Service Stocks

- Publicly Traded Cyber Security Stocks

- Publicly Traded Education and Training Stocks

- Publicly Traded Energy Stocks

- Publicly Traded Entertainment Stocks

- Publicly Traded Environmental Services Stocks

- Publicly Traded Financial Sector Stocks

- Publicly Traded Food and Beverage Stocks

- Publicly Traded Game and Hobby Stocks

- Publicly Traded Health and Fitness Stocks

- Publicly Traded Healthcare Facilities Stocks

- Publicly Traded Healthcare Stocks

- Publicly Traded Home Furnishing and Improvement Stocks

- Publicly Traded Industrial Stocks

- Publicly Traded Insurance Stocks

- Publicly Traded Internet Stocks

- Publicly Traded Materials Sector Stocks

- Publicly Traded Media Stocks

- Publicly Traded Medical Device and Equipment Stocks

- Publicly Traded Metal and Mining Stocks

- Publicly Traded Motor Vehicle Stocks

- Publicly Traded Multi Sector Stocks

- Publicly Traded Office Equipment and Supply Stocks

- Publicly Traded Pharmaceutical Stocks

- Publicly Traded Real Estate Stocks

- Publicly Traded Regional Major and Foreign Bank Stocks

- Publicly Traded REITs Stocks

- Publicly Traded Restaurants Stocks

- Publicly Traded Retail Stocks

- Publicly Traded Semiconductor Stocks

- Publicly Traded Shipping Stocks

- Publicly Traded Sin Stocks

- Publicly Traded Software Stocks

- Publicly Traded Sports Stocks

- Publicly Traded Technology Stocks

- Publicly Traded Telecommunications and Communications Stocks

- Publicly Traded Transportation Stocks

- Publicly Traded Travel and Tourism Stocks

- Publicly Traded Utilities Stocks

- SPDR Corporate & Government Bonds ETFs

- SPDR International ETFs

- Top 97 International Equity ETFs

- Portfolios

- Stock Charts

- MEGA VAULT

- Stream Movies

Categories

- Home

- MORE Courses

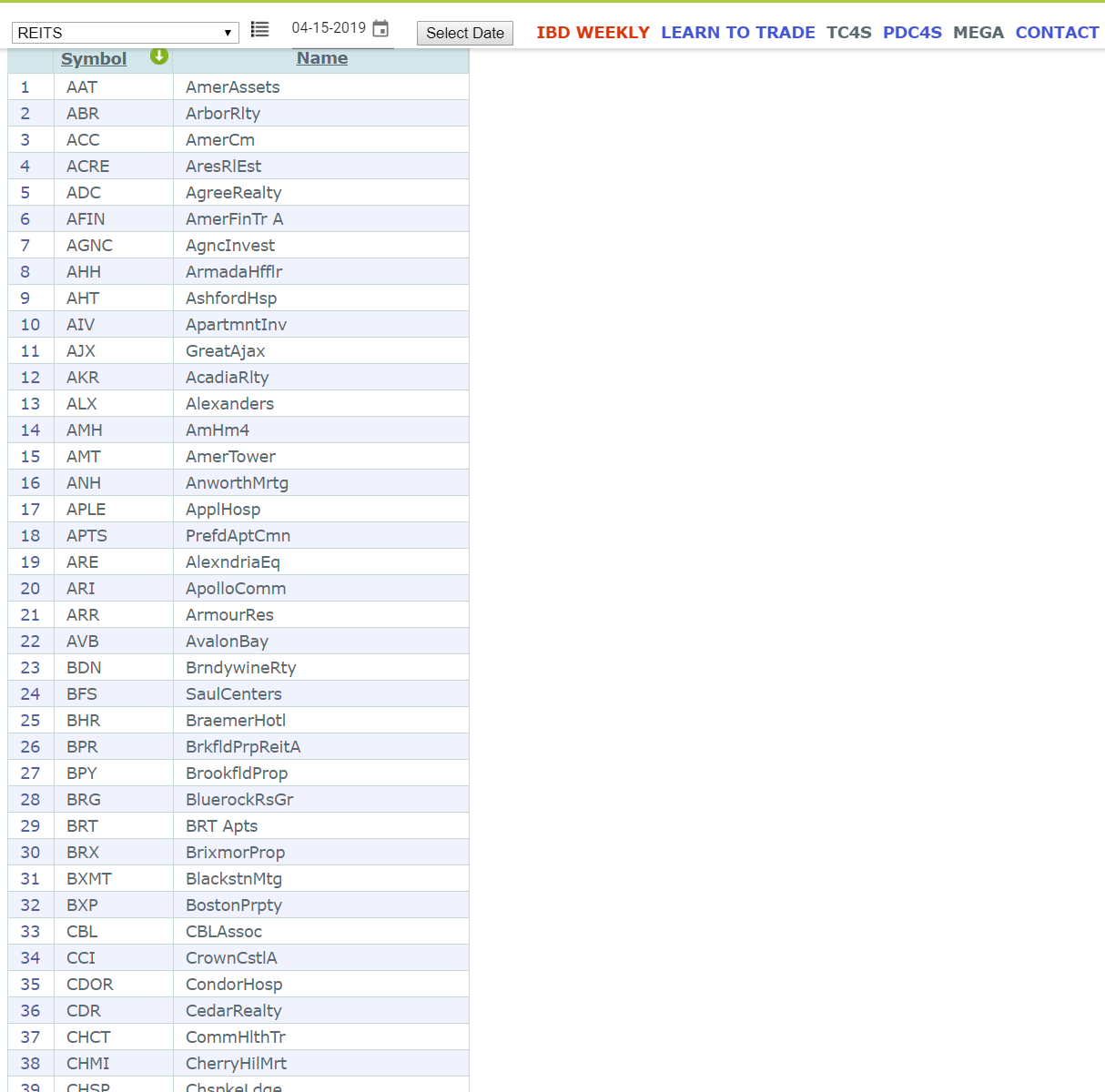

- REITs Stocks

Product Description

REITs, or real estate investment trusts, are companies that own or finance income-producing real estate in a range of property sectors. These companies have to meet a number of requirements to qualify as REITs. Most REITs trade on major stock exchanges, and they

offer a number of benefits to investors. Modeled after mutual funds, REITs provide all investors the chance to own valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive and revitalize.

REITs allow anyone to invest in portfolios of real estate assets the same way they invest in other industries - through the purchase of individual company stock or through a mutual fund or exchange traded fund (ETF). The stockholders of a REIT earn a share of the

income produced through real estate investment - without actually having to go out and buy, manage or finance property.

Most REITs operate along a straightforward and easily understandable business model: By leasing space and collecting rent on its real estate, the company generates income which is then paid out to shareholders in the form of dividends. REITs must pay out at least 90

percent of their taxable income to shareholders - and most pay out 100 percent.

REITs are real estate working for you. Through the diverse array of properties they own, finance and operate, REITs help provide the essential real estate we need to live, work and play. REITs of all types collectively own more than $3 trillion in gross assets across

the U.S., with stock-exchange listed REITs owning approximately $2 trillion in assets. U.S. listed REITs have an equity market capitalization of more than $1 trillion. In addition, more than 80 million Americans invest in REIT stocks through their 401(k) and other investment funds.

Click below for REITs Stocks